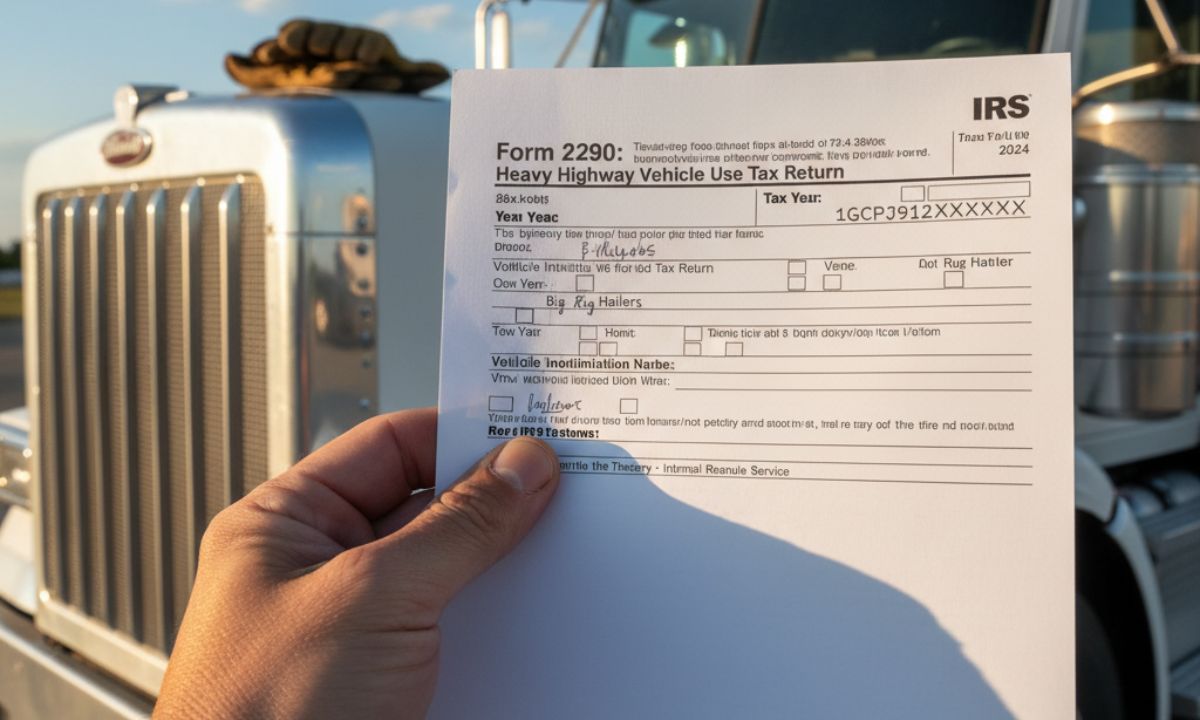

Form 2290 HVUT: Tips for a Hassle-Free Filing Experience

Form 2290 HVUT: A Guide to Hassle-Free Filing

Filing IRS Form 2290 Heavy Vehicle Use Tax (HVUT) seems insurmountable for truck owners and fleet operators. One needs to prepare and guide to make the process smooth, compliant, and time-saving and beneficial. Below are critical and essential tips and insights for effortless HVUT filing.

Getting to Know the Purpose of Form 2290 HVUT

The IRS requires Form 2290 for vehicles weighing 55,000 pounds and more. This tax is dedicated to maintaining the federal highways and compliance for heavy vehicle operations. The timely filling avoids penalties from the IRS, as well as keeps trucks within the right across-the-road.

Who Needs to Apply Form 2290 HVUT

Heavy highway vehicles owners and operators in the U.S. have to apply Form 2290. Logging trucks as well as those used for agricultural purposes may qualify to file, although there are lower tax rates involved. Being in compliance will help smooth operations and reduce the risk of interruption.

Noteworthy Dates to Remember

Running every year from July 1 through June 30, the HVUT tax period closes on the last day of the month following the first month that a vehicle uses public highways. Failure to comply results in penalties, interest charges, and suspension of registration of vehicles.

How to E-file Form 2290 HVUT

E-filing is the fastest, most reliable means for the completion of Form 2290. Steps include:

- Register with an IRS-approved e-file provider.

- Provide vehicle information such as VIN and gross taxable weight.

- Tax payment can be through EFTPS, direct debit or credit/debit card.

- Go to the DMV to register the vehicle w,ith Schedule 1 (proof of payment) immediately.

Common Mistakes to Avoid

- Entry of incorrect VIN leading to IRS rejections.

- Using a taxable gross weight section category that is wrong.

- Poor keeping track of deadlines.

- Forget to file about suspended and exempt vehicles.

Most rejections or delays can be avoided due to crosschecking of the particulars before submission.

Steps when a VIN Correction is Required

In the event that you entered the wrong VIN on the IRS form, the IRS provides a form for the correction of VIN. This ensures that the proper vehicle is recorded without paying the tax twice. The correction process is made much easier via e-filing platforms.

How to Claim Credit or Refund

Credits or refunds on Form 2290 can be claimed for overpayments, sold or destroyed vehicles. There will be various documents and evidence required to put in these claims. Filing electronically ensures quick approval.

The IRS Penalty for Late Filing

Form 2290 is impendent to submission at the time of deadline, or:

- 4.5% penalty of the total tax due per month delayed.

- 0.5% penalty for overdue taxes.

Interests over and above accumulate until payment is fulfilled.

Avoiding such penalties is possible by early and on-time submission using the e-filing platforms, which will keep reminding the taxpayer about deadlines.

Why Schedule 1 Proof Matters

The IRS gives Stamped Schedule 1 after successful filing. It is needed for:.

- – Renewing vehicle registration with DMV.

- – Legitimately operating across various states.

- – Fleet compliance audits.

Without enough Schedule 1, trucks risk being grounded.

Choosing an E-File Provider

The reliable e-file provider should provide:

- IRS authorization

- Around-the-clock customer support

- Error checks in real-time

- Instant delivery of Schedule 1

The good way to choose the platform guarantees a stress-free HVUT filing process.

Conclusion

Filing Form 2290 HVUT does not need to be a complex matter. Truth to tell, it could easily be simplified by e-filing solutions, deadline reminders, and the necessity for accurate information to be free of penalties and have smooth trucking operations. Compliance means smooth trucking operations using IRS regulations-hassle-free and uninterrupted business operations.

Disclaimer: The information provided in this blog post is for general informational purposes only. While we strive to keep the content accurate and up to date, we do not guarantee its completeness, reliability, or accuracy. Any actions you take based on this information are strictly at your own risk. We are not responsible for any losses, damages, or inconveniences that may arise from the use of this blog.