Form 2290 HVUT Explained: Everything Truckers Need to Know

Form 2290 Heavy Vehicle Use Tax Explained: Everything Truckers Should Know

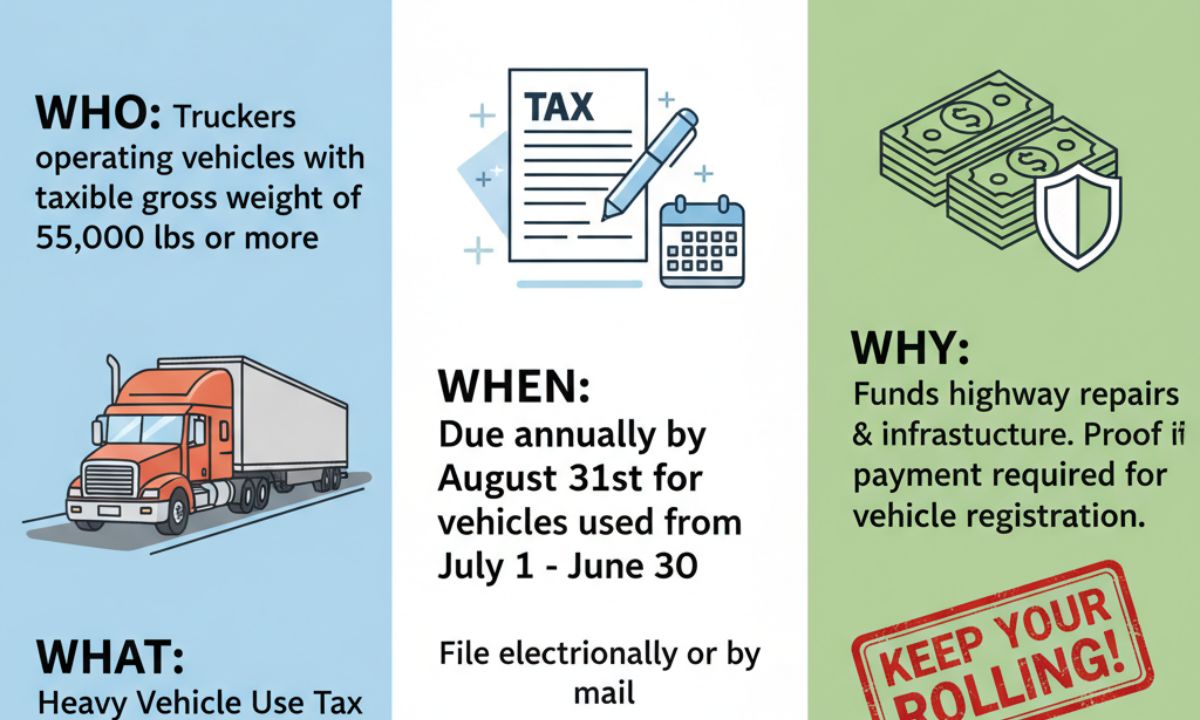

For truckers and fleet operators all across the United States, IRS Form 2290 Heavy Vehicle Use Tax (HVUT) is more than paperwork—it is a requirement that allows one to legally operate on public highways. Being in-the-know about what this tax is, why it is important, and how it should be filed so as to remain compliant and avoid costly penalties is key.

What Is Form 2290 HVUT?

Form 2290 is a federal highway use tax form from the IRS for vehicles with 55,000 gross weight pounds or greater. The deduction goes toward maintaining the highways and infrastructure directly supporting the roads that heavy trucks rely on. Therefore, without filling that form, there cannot be vehicle registrations, hence the cornerstone of trucking compliance.

Who Needs to File Form 2290

The HVUT applies to:

- Owner-operators with single heavy vehicles

- Fleet managers and trucking companies with multiple trucks

- Agricultural and logging carriers operating heavy-duty vehicles

- Vehicles crossing state or federal highways above the taxable weight threshold

Even vehicles that qualify for exemptions, such as those used under the mileage limit, must still be reported to the IRS.

Key Filing Deadlines for Truckers

The HVUT tax year runs from July 1 through June 30. The filing deadline depends on when the vehicle is first put into service:

- Filing is due by the last day of the month following the first use month.

- Vehicles first used in July must be filed by August 31.

- Late filing incurs penalties, interest, and potential for withholding truck registration renewals.

Required Information for Filing

Before a tax file, truckers should have the following information ready:

- Employer Identification Number (EIN) – required for all filings

- Vehicle Identification Number (VIN) – accuracy is critical

- Taxable gross weight – includes truck, trailer, and maximum load

- Payment Options: EFTPS, credit/debit card, or check/money order

Accuracy is essential. Even one-digit error in VIN can automatically cause rejection.

How to File Form 2290

Electronic Filing (Recommended)

- It is mandatory for fleets comprising of 25 or more vehicles

- It will provide stamped Schedule 1 proof of payment instantly

- Real-time error checking reduces the rejections

Paper Filing

- Permissible only in case of smaller fleets

- Cumbersome and subject to delays due to mail systems

- Will take weeks to receive Schedule 1

Most trucking experts will e-file through IRS-approved vendors owing to speed, accuracy, and compliance.

Avoiding Common Mistakes

Common mistakes include:

- Wrong VIN entry

- Wrong category for gross taxable weight

- Forgetting to file for suspended or exempt vehicles

- Missing deadlines due to inadequate record-keeping

One good practice would be to double-check all documents before submission to eliminate avoidable rejections.

How to Correct VIN

In the case of a VIN mistake, the IRS permits a VIN correction filing. This is quite easy on e-file platforms, also preventing double payments on taxes for the same vehicle.

Refunds and Credits

Truckers can be credited or refunded for any claims, i.e.:

- What happened to a vehicle sold or destroyed, or stolen

- During the tax year, a vehicle did not exceed 5,000 (7,500 for agricultural) miles

- An overpayment of tax during the previous filing

The credits can go against future filings or can be asked for as a refund.

IRS Penalties and Consequences

Not filing or not paying the HVUT would mean that:

- 4.5% penalty is charged per month until the whole tax due is paid for filing the tax return late

- 0.5% penalty is charged per month for late payment of tax

- With interest charged till the obligation is met

These penalty amounts could rise quickly, emphasizing the need for prompt compliance.

Why Schedule 1 Is Important

IRS Stamped Schedule 1 shows that the HVUT is duly filed and paid. This document is needed for:

- Registering vehicles with the DMV

- Cross-state trucking operations

- Fleet compliance audits

Without Schedule 1, trucks cannot be legitimately operated.

Choosing the Right E-File Provider

Factors to consider when choosing a filing platform are:

- IRS-approved

- Error checking tech to minimize rejection

- Ability to provide customer support all-time

- Capable of instant delivery for Schedule 1

The ideal provider will ensure the hassle-free and speedy process of HVUT filing.

Final Thoughts

Understanding Form 2290 HVUT is crucial for truckers and their lawful trade. Instead, it has become an avenue for the truckers to both avoid penalties and keep their trucks running. With accurate details, timely submission, and a reliable e-filing provider made easy, the HVUT truly works to keep trucking businesses safe-and support maintenance of the highways on which they thrive.

Disclaimer: The information provided in this blog post is for general informational purposes only. While we strive to keep the content accurate and up to date, we do not guarantee its completeness, reliability, or accuracy. Any actions you take based on this information are strictly at your own risk. We are not responsible for any losses, damages, or inconveniences that may arise from the use of this blog.