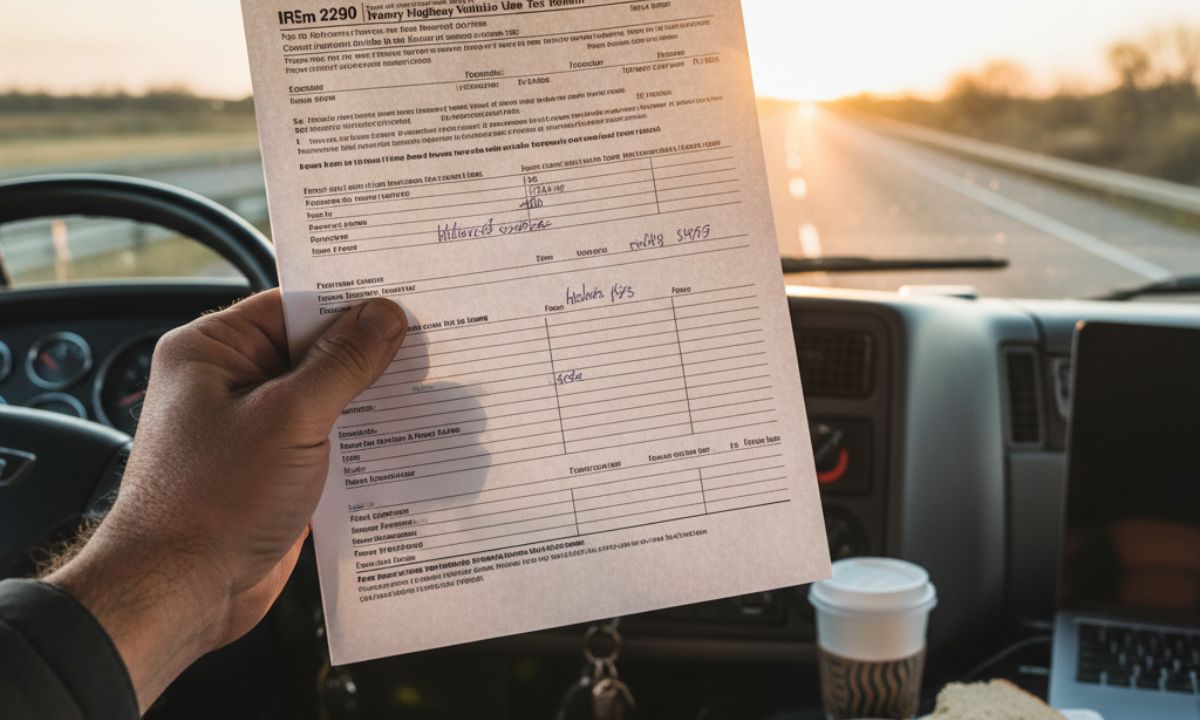

What Is Form 2290? A Beginner’s Guide to HVUT

Importantly, the document of Form 2290 is a mandatory tax requirement for every heavy vehicle owner or fleet manager in the U.S. This guide breaks down the basics for ease of understanding, concentrating on the beginners in the process-so that they get to know the processes, deadlines, and compliance essentials.

An Insight into Form 2290, HVUT

Form 2290 is a federal tax form required by the IRS for vehicles weighing 55,000 pounds or above that are in operation on public highways. The proceeds from the HVUT tax are used in highway infrastructure, making the law obeying of this tax very much a safety matter.

Who Is Required to File Form 2290?

Heavy highway vehicles, including owner-operators, trucking companies, carriers involved with agriculture, and those engaged with the logging field who own or operate vehicles, must file. Even the ones that may qualify for exemption or suspension need to be reported to maintain compliance.

Important Filing Deadlines

The HVUT is applicable for the time from July 1 of a year until June 30 of the succeeding year. Taxes are due by the end of the month following the month of the first use. A missed deadline could earn penalties from the IRS, resulting in fines and/or possibly a suspended registration.

How To File Form 2290

There are two methods of filing the returns:

- E-filing: fastest and recommended among providers approved by IRS.

- Paper filing: available only to fleets with less than 25 vehicles at a very slow pace and prone to errors.

Following e-filing, the truckers get a stamped Schedule 1 from the IRS service providers almost instantly, which is mandatory for DMV registration.

Key Information That Must Be Had Before Filing

The vehicle owners should be ready with the following requirements before completing the Form 2290:

- Employer Identification Number (EIN)

- Vehicle Identification Number (VIN)

- Taxable gross weight of the vehicle

- Payment details (EFTPS, debit, credit card, or check)

The right details should be submitted to avoid a rejection or delay in receiving Schedule 1.

Common Mistakes That Result in Rejections by the IRS

- Wrong VIN entered;

- The wrong taxable gross weight category selected;

- Late filings without extensions;

- Not filing for suspended or exempt vehicles.

Filers can avoid avoiding any sort of complication by reviewing all the details before submission.

VIN Correction Proceeding

Mistakes concerning Vehicle Identification Numbers are common. VIN corrections are allowable through a separate filing procedure by the IRS. E-filing providers will make this painless so that truckers are not charged tax twice.

Claiming Credits and Refunds

Credits and refunds are available to vehicles that are sold, destroyed, or operated below taxable mileage through Form 2290. With proper documentation, e-filing guarantees speedy processing.

IRS Penalties and Compliance Risks

Late filing or payment may accrue:

- 4.5% penalty monthly on the total tax due

- 0.5% penalty monthly on late payments

- Additional interest charges

Being abreast of the deadlines will keep the vehicles compliant and ready for the road.

Importance of Schedule 1 Proof

A Schedule 1-Proof of Payment-is presented to the IRS after successful filing. It is mandatory for:

- Renewal of vehicle registration

- Operations across state lines

- Department of Transportation audit

Without Schedule 1, the trucks may not be able to operate.

Best E-Filing Partner Defined

The right e-filing partner will streamline the HVUT filing process. Look for:

- IRS authorization

- Error-checking technology

- 24/7 customer support

- Instant Schedule 1 issuance

Such a provision will guarantee compliance, correctness, peace of mind for your trucking profession.

Conclusion

For the beginner, Form 2290 HVUT might appear a bit complicated, but if the right information is heeded, filed on time, and worked with a good e-filing provider, it is made easy. Being compliant will not only eliminate the risk for penalties, but also allow trucks to stay operationally legal on U.S. highways.

Disclaimer: The information provided in this blog post is for general informational purposes only. While we strive to keep the content accurate and up to date, we do not guarantee its completeness, reliability, or accuracy. Any actions you take based on this information are strictly at your own risk. We are not responsible for any losses, damages, or inconveniences that may arise from the use of this blog.